You see your profit margins shrinking every month. You worry about the rising costs of importing goods1. Tariffs are eating your business alive, and you need a solution now.

To adapt to US tariffs, retailers and suppliers must collaborate on three fronts: re-engineering product designs for better HS codes2, utilizing the Section 321 "De Minimis" rule for direct shipping3, and restructuring supply chains via "China Plus One" or the "First Sale Rule4" to legally reduce dutiable value.

Prices go up. Margins go down. This is the reality we face today. But we can fix this together. I have run my factory for 15 years. I have seen trade wars5 come and go. We do not have to just accept higher taxes. We can be smart. We can change how we work. Let me show you exactly how we do it.

Can Smart Design Changes Lower Your Import Duties?

You pay too much tax on every shipment. It hurts your bottom line significantly. Often, the reason is just one small choice of material or a simple feature.

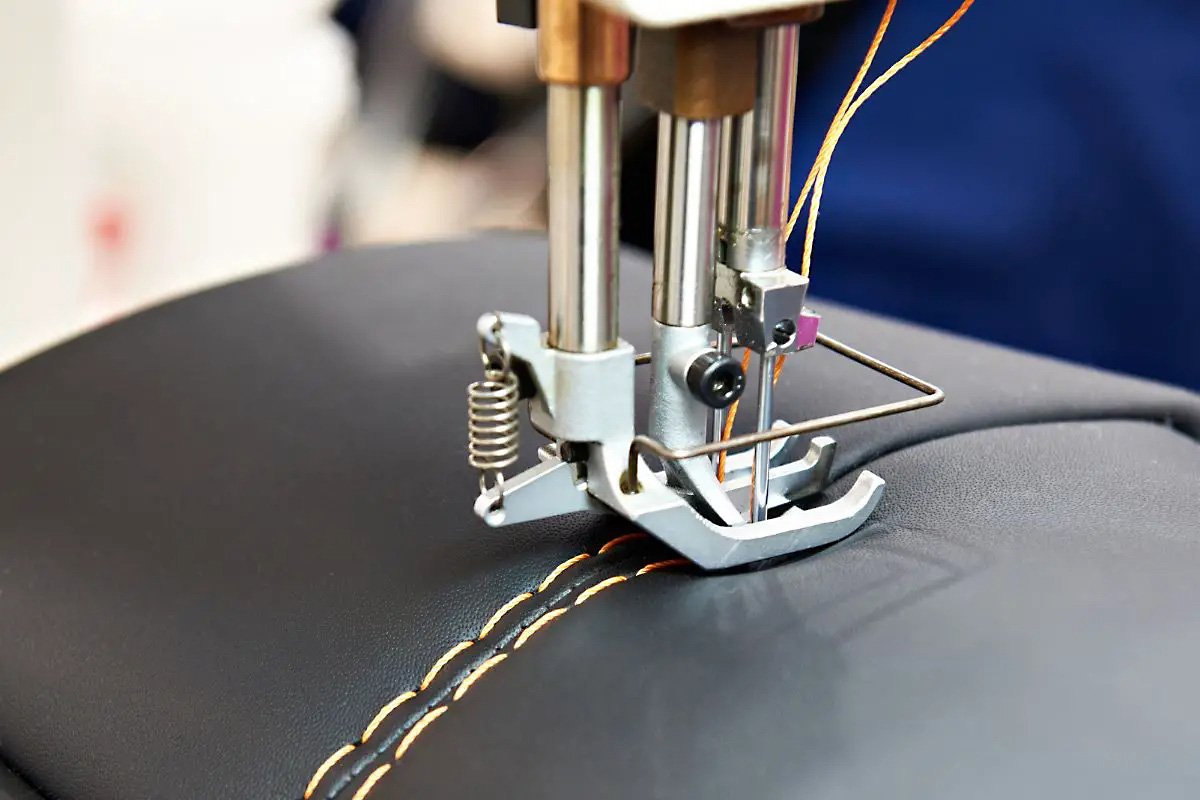

Changing specific materials or functional elements allows products to be classified under different HS codes2 with lower duty rates. This engineering approach requires deep knowledge of customs classifications6 to find legal tax savings without sacrificing quality.

I see this happen all the time in my factory. A customer comes to me with a design. It looks great. But I look at the material and I see a problem. The Harmonized System (HS) codes are very specific. If a bag has an outer surface of plastic sheeting, the tax is high. If the outer surface is textile, the tax might be lower.

We use critical thinking here. We do not just copy your drawing. We analyze it. For example, I had a client who wanted a cooler bag. The original design had a 100% plastic outer shell. The tariff on that was huge. I suggested a change. We used a durable polyester fabric with a heavy coating7 instead. It looked almost the same. It performed the same. But the HS code changed. The duty rate dropped by 10%.

Here is how we break down the design process to save money:

| Design Element | Original Choice (High Tax) | Adjusted Choice (Low Tax) | Result |

|---|---|---|---|

| Outer Material | Solid Plastic Sheet | Coated Textile Fabric | Lower Duty Rate |

| Lining | Expensive Synthetic | Standard Cotton | Same Utility, Lower Value |

| Strap Material | Leather | Webbing | Changes "Essential Character8" |

We also look at functionality. Sometimes, adding a specific pocket or changing the closure method changes the category. If a bag is considered "luggage," it pays one rate. If it is a "shopping bag," it pays another. We look at the "Essential Character8" rule in customs law. This is where my 15 years of experience helps. I know the book. I know the rules. We adjust the product to fit the best rule. We do not cheat. We just design smarter. You get the quality you want. But you keep more money in your pocket.

How Does the Section 321 Rule Save You Money?

Big bulk orders get stuck at customs for days. You pay huge fees on the total value. There is a faster, cheaper way for your smaller shipments.

The Section 321 rule allows shipments valued under $800 to enter the US duty-free. By shifting from bulk container imports to a direct-to-consumer drop-shipping model, businesses can legally bypass massive tariff bills on individual customer orders.

This strategy is a game-changer for my customers who sell online. Usually, you operate on a traditional model. You buy a 40-foot container of backpacks from me. You import it to Canada or the US. You pay the tariff on the whole $50,000 value. Then you store it in a warehouse. Then you ship it to the customer. This is slow. This is expensive.

Now, we use the "Section 321" loophole. It is also called the De Minimis value. The US allows one person to import up to $800 worth of goods per day without paying duties or taxes. This is huge.

We change the supply chain. You do not import the container to your warehouse. You send me the orders. I pack them individually in my factory. I label them for your final customer. We ship them directly to the US. Or, we ship a bulk container to a bonded warehouse in Mexico or Canada. The goods sit there tax-free. When a customer buys a bag, we ship it across the border. The value is $50. It is under $800. So, the tax is zero.

Here is the comparison:

| Feature | Traditional Bulk Import | Section 321 Model |

|---|---|---|

| Duty Payment | Paid on full container value | $0 (if under $800/order) |

| Warehousing | You pay for US storage | We store or use bonded zones |

| Speed | Slow (Customs clearance) | Fast (Express clearance) |

| Cash Flow | Money tied up in tax | Money stays in business |

I have 120 workers. We adapted our production line for this. We used to only pack big cartons. Now, we have a team that does "pick and pack." We put your brand card inside. We make it look like it came from your store. You save the tariff. You save the warehouse cost. You can offer a lower price than your competitor. This works best for high-volume, low-value items like our cosmetic bags or simple totes.

Is the China Plus One Strategy Right for Your Supply Chain?

You fear relying only on China factories. The geopolitical risk is high. You need a backup plan to keep your prices stable and delivery safe.

The "China Plus One" strategy involves moving final assembly to countries like Vietnam to change the Country of Origin. Alternatively, the "First Sale Rule4" lowers customs value by basing duties on the factory price, not the middleman price.

We have to look at the big picture. Tariffs on Chinese goods are high. This is a fact. To fix this, we look at where the bag is made. The rule says the "Country of Origin" is where the substantial transformation happens.

We use the "China Plus One" strategy. I have my main factory in China. We have 3,000 square meters here. We make the materials. We cut the fabric. We do the difficult parts. Then, we ship these parts to a partner factory in a country like Vietnam or Cambodia. The workers there sew the bag together. They do the final assembly. They pack it. The label says "Made in Vietnam." The US tariff on Vietnamese bags is much lower than Chinese bags.

This takes work. We manage the quality. I send my QC team to the other factory. We ensure the standard is the same. You get the same Coraggio quality. But you get a different label.

Another method is the "First Sale Rule4." This is for when you buy through a trading company or if there are multiple steps. Usually, customs charge tax on the price you pay. But if we can prove the goods were destined for the US from the start, you can pay tax on the first price. That is the price the factory sold it for. This price is lower. So the tax is lower.

Let's look at the impact on your cost:

| Strategy | Base for Tax | Country of Origin | Complexity |

|---|---|---|---|

| Direct from China | Invoice Price | China (High Tariff) | Low |

| China Plus One | Invoice Price | Third Country (Low Tariff) | High |

| First Sale Rule4 | Factory Cost | China (High Tariff) | Medium |

We help you decide. If your order is huge, we move to Vietnam. If your order is medium, we use the First Sale Rule4. We have the team to handle the paperwork. We have the production lines to support the move. We do not just make bags. We build a supply chain that saves you money. You stay competitive. Mark, I know you want low prices and good quality. This is how we give you both.

Conclusion

Tariffs are hard, but we beat them with smart design, Section 321 shipping, and global supply chains to keep your profits high.

Understand the current challenges in importing goods to better navigate the complexities of international trade. ↩

Understanding HS codes is crucial for optimizing your import duties and ensuring compliance with customs regulations. ↩

Discover the advantages of direct shipping, including cost savings and faster delivery times. ↩

Understand the First Sale Rule to potentially lower your customs duties based on factory prices. ↩

Gain insights into the impact of trade wars on businesses and how to adapt your strategies accordingly. ↩

Gain insights into customs classifications to ensure your products are categorized correctly for lower duties. ↩

Learn the specific "naked eye" visibility standards for coatings to ensure your material changes legally qualify for reduced import duties. ↩

Master the specific criteria US Customs uses to classify composite goods. This knowledge is crucial for legally lowering your duty rates. ↩