Shipping terms can give anyone a headache. You just want your custom backpacks delivered to your warehouse without stress, right? But choosing the wrong shipping term can lead to hidden costs1 and legal trouble.

DDP stands for Delivered Duty Paid. It means the seller handles everything, including shipping, customs2, and taxes, until the bags reach your door. However, "DDP Fraud3" happens when sellers use illegal methods to lower these costs, putting your cargo at risk of seizure.

Many buyers love DDP because it seems easy. But "easy" can be dangerous. I have seen many buyers lose money because they did not understand what happens behind the scenes. Let's look at the details so you can protect your business.

What Does DDP Mean in Bag Imports?

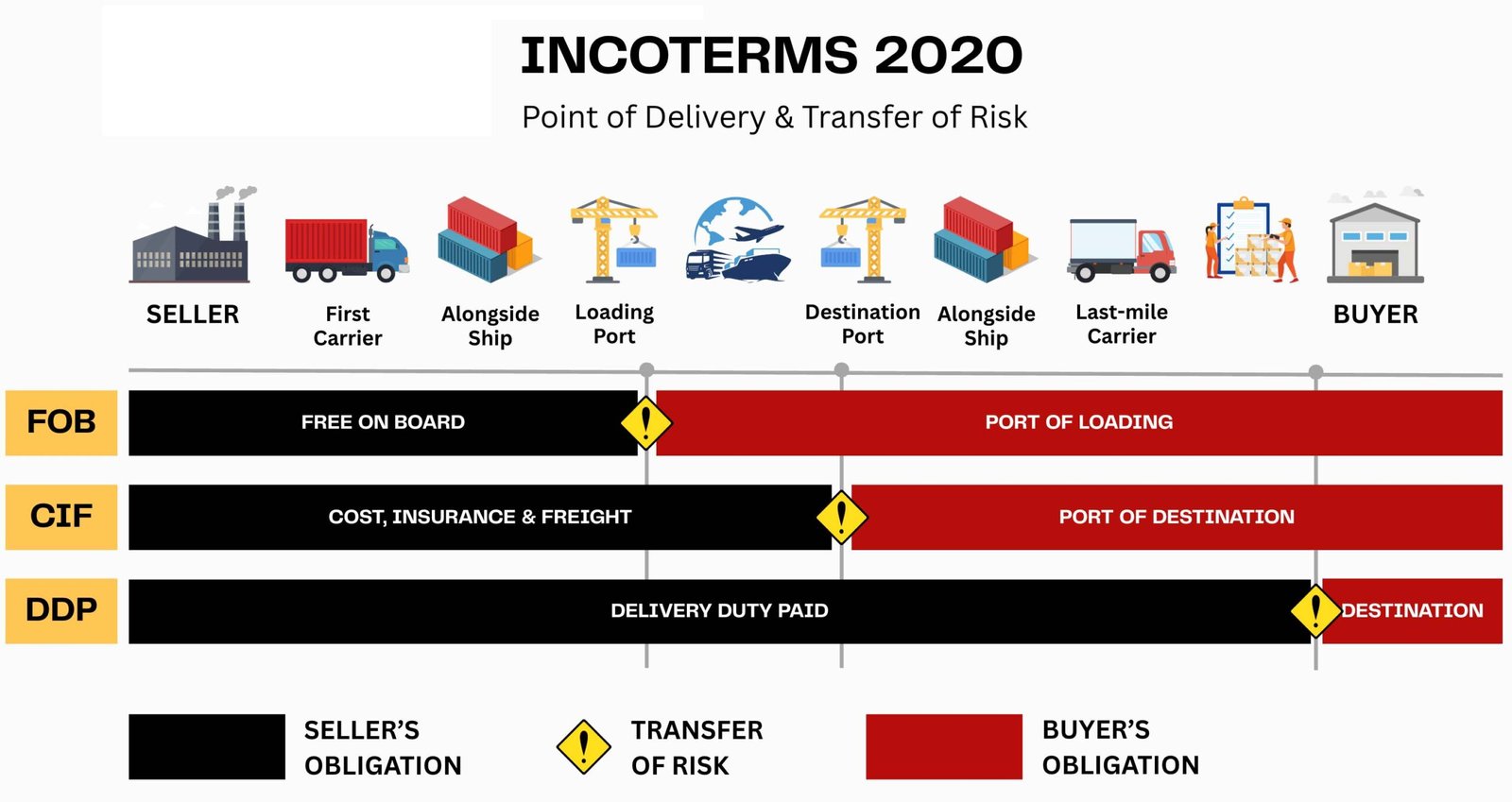

Do you feel confused by acronyms like FOB, CIF, and DDP? You are not alone. Many of my clients find these terms frustrating when they just want to buy bags.

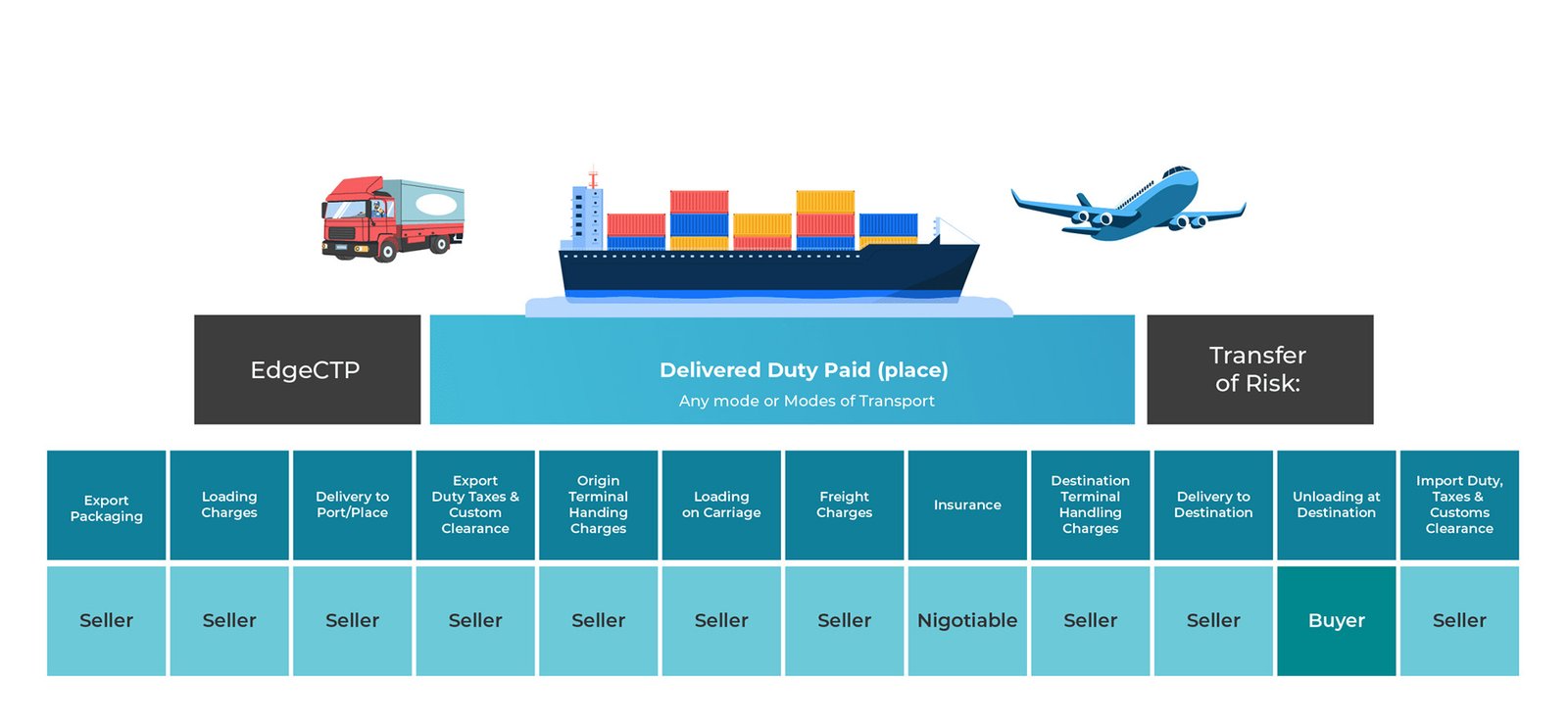

DDP means the seller takes maximum responsibility. We arrange the transport from our factory in China to your specific address. We pay the shipping, insurance, and import duties4. You only take responsibility once the truck arrives at your warehouse.

I want to explain this clearly because it changes how we do business. In my 15 years of manufacturing bags, I see DDP as the "full service" option. When you choose DDP, you are asking the factory to act like a local supplier. We do not just make the tote bags or cooler bags; we also become the logistics manager5.

Think of it like ordering a pizza. You pay one price, and it shows up at your door. You do not worry about the driver's gas or the traffic. Under DDP, the seller accepts all the risks. If the ship sinks? Seller's problem. If customs2 holds the goods? Seller's problem. If the truck breaks down? Seller's problem.

Here is a simple breakdown of responsibilities:

| Responsibility | FOB (Free On Board) | DDP (Delivered Duty Paid) |

|---|---|---|

| Export Clearance | Seller | Seller |

| Ocean/Air Freight | Buyer | Seller |

| Import Customs | Buyer | Seller |

| Import Duties/Taxes | Buyer | Seller |

| Final Delivery | Buyer | Seller |

For a buyer like you, this sounds perfect. You do not need to hire a customs broker6s://www.investopedia.com/terms/d/delivery-duty-paid.asp)2 broker. You do not need to calculate tariffs7. You just wait for the goods. But, because the seller controls the process, you lose visibility. This is where problems can start.

Who Pays What Under DDP? Duties, VAT, Customs & Last-Mile?

Do you think the "all-in" price covers absolutely everything? Sometimes, a lazy freight forwarder8 will try to charge you extra fees at the very end.

Under a true DDP agreement, the seller pays for the freight, cargo insurance, import duties4, Value Added Tax (VAT)9, and the final truck delivery. As the buyer, you should not pay a single penny to the delivery driver or customs2 authority.

Let's dig deeper into the money side. When I give you a DDP price for 5,000 backpacks, I have to calculate many different costs. It is not just the cost of the fabric and the zipper. I must estimate what the government in your country will charge.

First, there is the Duty. This is the tax on the category of goods. For bags made of polyester or canvas, the duty rate varies by country. In the US or Canada, this can be high. Under DDP, I pay this.

Second, there is VAT or GST. This is the sales tax on imports. Usually, the seller pays this to clear customs2. However, this part is tricky for B2B. Often, you (the buyer) want to claim this tax back. If I pay it, you might not get the receipt to claim the refund. We need to discuss this before shipping.

Third, there is Customs Brokerage. This is the fee for the agent who files the paperwork. I pay this.

Fourth, there is Last-Mile Delivery. This is the truck or van that takes the pallets from the port to your door. I pay this.

If a delivery driver shows up and asks you for a "dock fee10" or "handling fee," that is wrong. Under DDP, I have already paid that. You need to know these components. If you do not know them, you cannot spot a bad price. A price that is too low usually means one of these costs is missing.

Why Is DDP Fraud on the Rise in B2B Bag Sourcing?

Are you seeing DDP prices from other suppliers that look too good to be true? They probably are. Cheap shipping often hides illegal activities.

DDP fraud is rising because dishonest sellers hide costs in a "black box." They undervalue the goods or use the wrong product codes to pay less tax. This helps them offer a lower price, but it puts your company at legal risk.

I have seen this happen too many times. A new client comes to me. They say, "Coraggio, your bag price is good, but your DDP shipping is expensive. Another factory offers shipping for half your price." I look at the numbers. The other factory's price is mathematically impossible if they follow the law.

This is how the fraud works. The "DDP Fraud3" creates a black box. You pay the seller a lump sum. The seller hires a cheap, shady logistics company. This company lies to customs2.

Method 1: Undervaluation. You pay $10 per bag. The logistics company tells customs2 the bag is worth $2. They pay tax on $2. They keep the difference.

Method 2: Wrong HS Code11. They declare your high-quality backpacks as "shopping bags" or "laundry bags" which might have a lower tax rate.

Method 3: Grey Clearance. They smuggle the goods through a different channel or country to avoid taxes completely.

Why is this bad for you? You got your bags cheap, right? The problem arises when the tax authority audits the shipment. If they find the fraud, they do not care that you bought DDP. You are the receiver. They can seize your goods. They can fine you. They can put your company on a blacklist. The seller in China is far away, but you are right there.

What Are the Red Flags of a “Too-Cheap” DDP Quote?

How do you spot a scammer before you pay the deposit? You do not need to be a shipping expert, you just need to do basic math.

The biggest red flag is a DDP price that is lower than the Cost of Goods plus the standard Duty rate. Also, watch out if the seller refuses to provide official tax receipts or customs2 documents after the shipment arrives.

You need to use critical thinking here. Let's break down a real example. Imagine you are buying cooler bags.

The Math Test:

- FOB Price of the bag: $5.00

- Import Duty in your country: 20% (Just an example)

- Duty Cost: $1.00

- Freight cost per bag: $0.50

The minimum DDP price must be $6.50 ($5 + $1 + $0.50). This does not even include profit or local delivery.

Now, imagine a supplier offers you DDP for $5.80. How is that possible? Even if they have a great shipping contract12, they cannot make the freight free. And they cannot change the government tax rate. The only way they hit $5.80 is by lying to customs2. They are likely declaring the bag value at $1.00 instead of $5.00.

Other Red Flags:

- No Paperwork: You ask for the "Entry Summary" or tax receipt, and they make excuses. They say "It is a consolidated shipment, we cannot share it." This is often a lie.

- Cash Only: The freight agent asks for cash payments for delivery.

- Generic Descriptions: The bill of lading says "polyester goods" instead of "insulated cooler bags."

If the deal relies on the seller cheating the government, it is not a deal. It is a trap.

How Can Bag Buyers Use DDP Safely? (Checklist & Best Practices)

Do you have to avoid DDP completely? No, DDP is very convenient. You just need to force the seller to be transparent.

To use DDP safely, demand transparency. Ask for official tax receipts, define who the "Importer of Record" is in the contract, and verify the freight forwarder8. Do not accept a "black box" price without seeing the details.

At Coraggio, we support DDP, but we do it the right way. We want our clients to be safe. Here is a checklist you should use with any supplier in China.

1. Clarify the "Importer of Record" (IOR) Who is legally importing the goods? Is it the seller's entity in your country, or is it you? If it is you, you are liable. Make sure the seller uses your tax ID correctly if you are the IOR.

2. Demand Tax Receipts Put this in your contract: "Seller must provide official customs2 tax and duty receipts within 7 days of clearance." If they cheat on the value, the receipt will show it. If they refuse to give the receipt, do not pay the balance.

3. Separate the Costs Ask for a quote that breaks down the costs.

- Product Cost: $X

- Shipping: $Y

- Duty & Tax: $Z Do not just accept one big number. Seeing the breakdown helps you check if the tax amount is realistic.

4. Check the HS Code Ask the supplier: "What HS code (commodity code) will you use for customs2?" Check this code yourself. Does it match your product? If they use a code for "textile scraps" but you are buying "backpacks," stop them.

5. Hold the Balance Payment If possible, do not pay the final balance until you have proof of legal clearance. This gives you leverage.

DDP is a great tool for managing cash flow and simplifying logistics. But it requires trust and verification. Do not let a cheap price blind you to the risks.

Conclusion

DDP shipping removes the headache of logistics, but DDP fraud brings the headache of legal risk. Always verify that your supplier pays the correct duties to keep your business safe.

Identifying hidden costs can save you money and prevent budget overruns. ↩

Explore customs responsibilities to ensure compliance and avoid unexpected fees. ↩

Learn how to spot DDP fraud to protect your business from hidden costs and legal issues. ↩

Understanding import duties helps you calculate total shipping costs accurately. ↩

Understanding the logistics manager's role can enhance your shipping strategy. ↩

Explore the role of customs brokers to simplify your import process. ↩

Learn how tariffs impact your overall shipping expenses and budgeting. ↩

Discover the importance of freight forwarders in managing shipping logistics. ↩

Learn about VAT implications to ensure you can claim refunds correctly. ↩

Understanding dock fees can help you identify potential hidden costs in shipping. ↩

Learn about HS Codes to ensure correct customs declarations and avoid penalties. ↩

Understanding shipping contracts ensures clarity and protects your interests. ↩