Tariffs are rising, and your profit margins1 are shrinking. Are you worried about hidden costs2 eating your budget before the bags even arrive at your warehouse?

2026 tariff changes increase landed cost3s through higher duty rate4s and stricter customs enforcement5. Even if factory prices stay flat, taxes and clearance fees will rise. You must recalculate total costs based on new HS codes6 and trade agreements to protect your margins.

Many buyers focus only on the unit price from the factory. However, the real cost involves much more. Let me explain how to handle this.

Which Cost Components Change When Tariffs Shift in 2026?

You negotiated a great price, but the final invoice is shocking. Why did the total cost jump so high after the goods arrived at the port?

When tariffs7 shift, the base duty rate4 increases, but so do the merchandise processing fees8 and potential harbor maintenance fees9. These are calculated as a percentage of the total value, meaning a small tariff hike ripples through every part of your final bill.

When we talk about the price of a bag, most buyers only look at the FOB price. This is the price I give you for the product itself. However, the "Landed Cost" is what truly matters to your bottom line. Landed cost is the total price of a product once it has arrived at your doorstep.

In 2026, tariff adjustments will change the math completely. Even if I keep my manufacturing price the same, your cost goes up. Why? Because tariffs7 are not just a simple fee. They act as a multiplier.

Here is a breakdown of the components that change:

| Component | Description | Impact of Tariff Hike |

|---|---|---|

| Duty Rate | The percentage tax charged by your government. | Direct increase in cost. |

| MPF (Merchandise Processing Fee) | A fee charged by customs to process the trade. | Often based on value; higher value means higher fees. |

| HMF (Harbor Maintenance Fee) | A fee for using sea ports. | Calculated on the value of the cargo, including duty in some cases. |

| Bond Fees | Insurance for customs payments. | Higher tariffs7 require a larger bond, costing you more. |

I have seen many buyers from North America panic when they see the final bill. They realized too late that a 10% increase in tariffs7 actually resulted in a 15% increase in total landed cost3 because of these compounding fees. At Coraggio, we help you estimate these costs early. We do not want you to be surprised. We want you to be profitable.

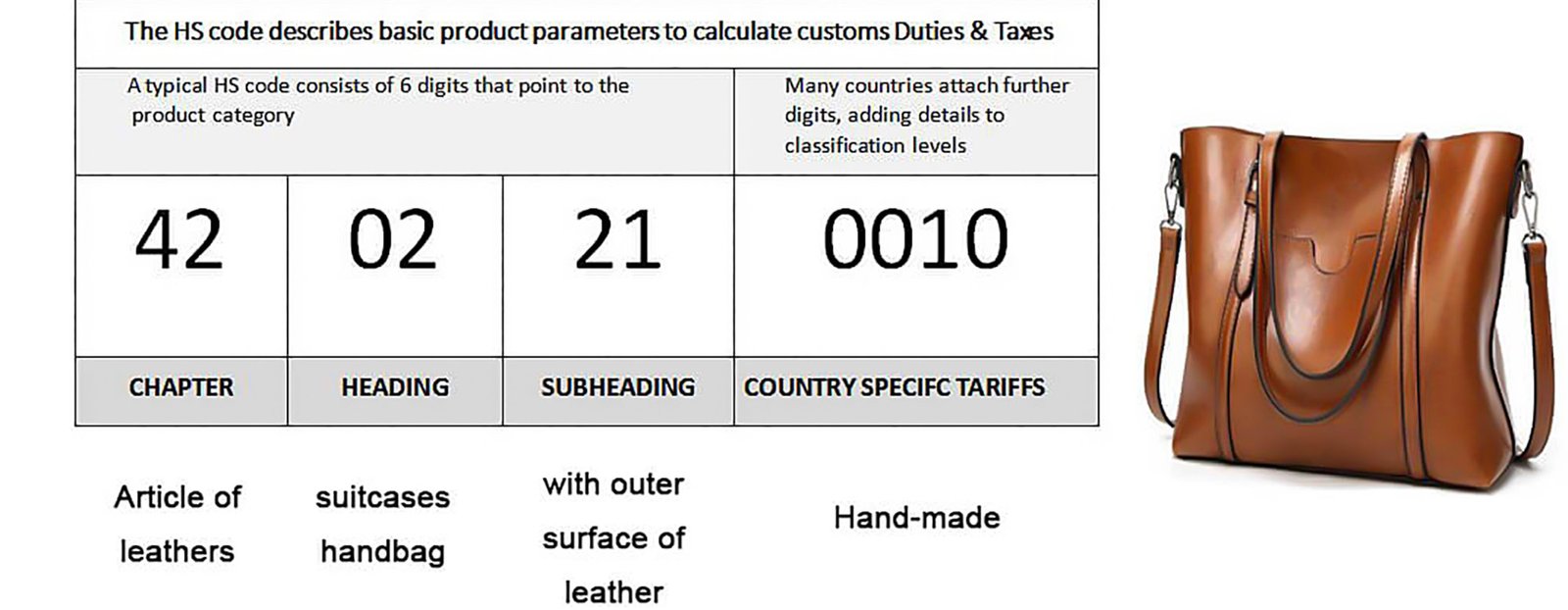

How Do HS Codes Affect Bag Duty Rates and Landed Cost?

Using the wrong code on your customs forms can be a disaster. Do you know exactly which code applies to your specific bag material?

HS Codes determine the specific duty percentage for your bags. A tote bag made of cotton has a different rate than one made of polyester. Selecting the correct code is critical because a mistake can lead to fines, delays, or paying a much higher tax rate than necessary.

The Harmonized System (HS) Code is like an ID card for your product. Every bag has one. However, bags are tricky. The code depends heavily on the outer surface material. This is where many buyers lose money without knowing it.

For example, a backpack made of 100% polyester has a different tax rate than a backpack made of cotton canvas. Sometimes, the design team adds a leather trim to a polyester bag. If that leather trim is significant, customs might argue the bag should be classified as a leather product. Leather goods usually have different, often higher, duty rate4s.

Here is how the material changes the classification:

| Bag Type | Material | Typical HS Code Chapter | Risk Level |

|---|---|---|---|

| Tote Bag | Cotton | Chapter 42 | Low (Stable rates usually) |

| Duffle Bag | Polyester/Nylon | Chapter 42 | High (Subject to specific trade wars) |

| Cosmetic Bag | PVC/Plastic | Chapter 39 or 42 | Medium (Depends on structure) |

In 2026, authorities are becoming stricter. They are looking closely at "essential character." If you import a cooler bag, is it a bag (Chapter 42) or a cooling device? The difference in tax can be huge.

I always advise my clients to double-check the material composition before we start mass production. We can sometimes adjust the material slightly to fit a better HS Code. For example, changing a lining or a coating might save you money on taxes. We need to define this in the contract. If we leave it to the shipping agent at the last minute, they might guess the wrong code, and you pay the price.

How Do Country of Origin Rules Impact Bag Sourcing Costs?

You think buying from a specific country saves money. But what if the raw materials come from somewhere else?

Country of Origin rules look at where the substantial transformation10 of the product happens. If the fabric is from one country but the bag is sewn in another, the tariff rate depends on specific trade agreements. You need clear documentation to prove origin and avoid unexpected penalty tariffs7.

Country of Origin (CO) is not just about where the factory is located. It is about where the value is added. In the bag industry, this is a very hot topic.

Many buyers try to avoid tariffs7 on Chinese goods by moving orders to other countries like Vietnam or India. However, the supply chain is complex. If we buy the fabric, zippers, and buckles in China, send them to another country, and only do simple sewing there, customs might say the origin is still China. This means you still pay the high tariff.

This concept is called "Substantial Transformation." To qualify for a lower tariff, the product must change significantly in the new country.

- Scenario A: We cut and sew the fabric in our China factory. The origin is China.

- Scenario B: We send fabric to another country, but they only pack it. The origin is likely still China.

- Scenario C: We export raw yarn, and the other country weaves the fabric and sews the bag. The origin is likely the new country.

In 2026, rules are getting tighter. Customs officers require more proof. They want to see the trail of the materials.

At Coraggio, we have 15 years of experience. We know how to manage this. We provide full documentation. We show where the fabric was made, where it was cut, and where it was sewn. This paper trail protects you. If customs audits your shipment, you have the proof you need. Without this proof, they can reject your claim and charge you the maximum tax rate retroactively. That destroys your profit for the whole year.

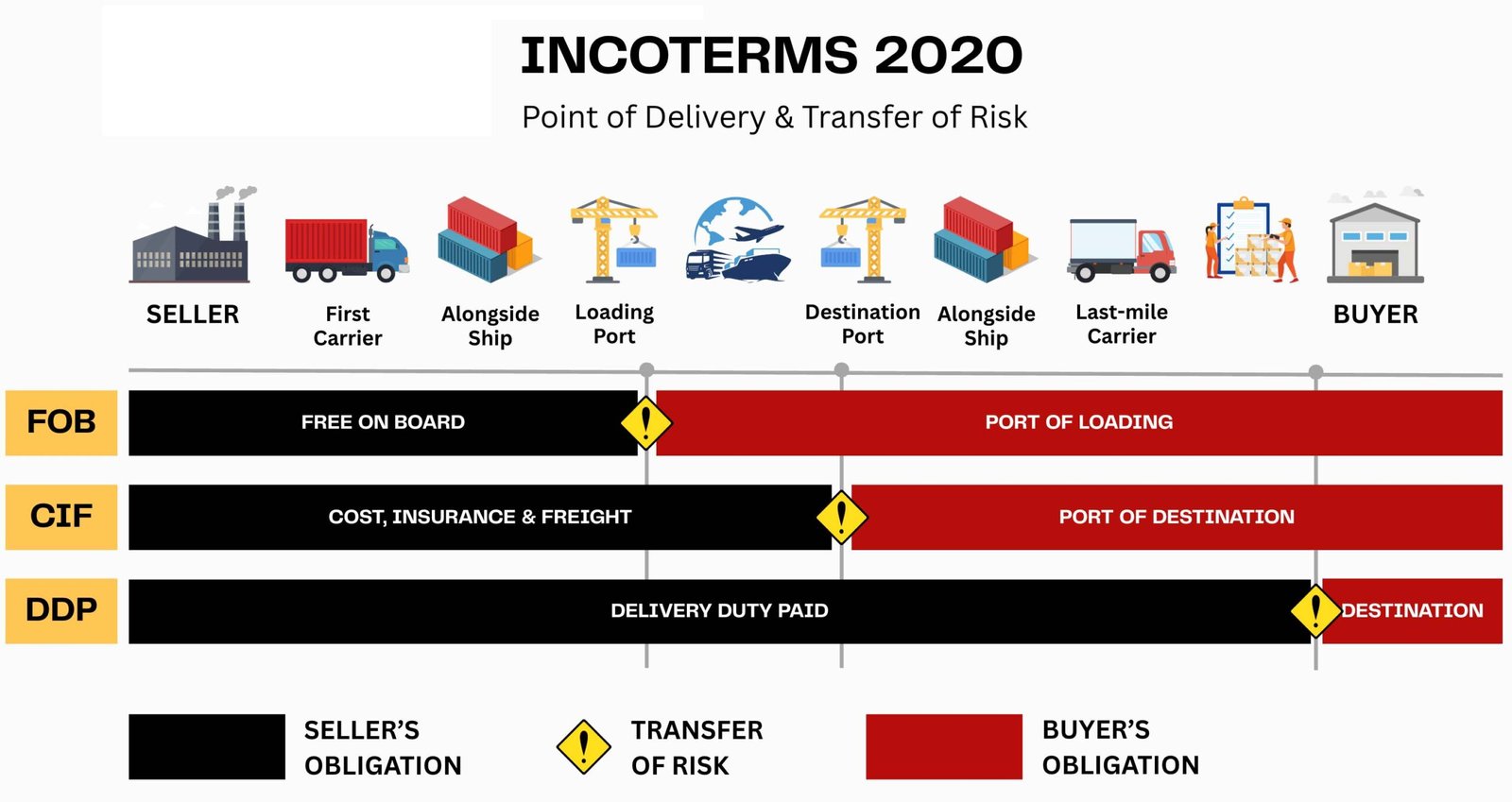

Which Incoterms (FOB/CIF/DDP) Change Who Pays Tariffs and Risk?

Who pays the bill when the goods hit the port? If you choose the wrong shipping term, you might face a surprise bill.

Incoterms11 like FOB, CIF, and DDP define who is responsible for paying the tariffs7. Under DDP, the supplier pays. Under FOB, you pay. Choosing the right term gives you control over the customs process and prevents the supplier from hiding extra costs in the shipping fee.

Incoterms11 are the rules of the game for international shipping. They tell us who pays for what and when the risk transfers from me (the seller) to you (the buyer).

When tariffs7 are volatile, the choice of Incoterm becomes a strategic financial decision.

1. FOB (Free on Board): This is the most common for experienced buyers. I put the goods on the ship, and my job is done. You pay for the ocean freight and the tariffs7.

- Pros: You control the shipping cost and the customs broker. You know exactly what the tax is.

- Cons: You take the risk if tariffs7 jump while the boat is on the water.

2. CIF (Cost, Insurance, and Freight): I pay for the shipping to your port.

- Pros: Less work for you initially.

- Cons: You still usually pay the tariffs7 and import duties12. Also, I might pick a cheap, slow ship to save my own money.

3. DDP (Delivered Duty Paid): I pay for everything. I pay the shipping, the insurance, and the tariffs7. I deliver the bags to your door.

- Pros: It is very easy for you. You see one final price.

- Cons: I have to charge you a premium to cover my risk. If I think tariffs7 might go up, I will add a buffer to the price. You might pay more than necessary.

| Incoterm | Buyer Responsibility | Supplier Responsibility | Tariff Risk Holder |

|---|---|---|---|

| FOB | Freight, Insurance, Duty | Production, Export Customs | Buyer |

| CIF | Duty, Import Clearance | Production, Freight, Insurance | Buyer |

| DDP | Unloading at warehouse | Everything (Door to Door) | Supplier |

For a buyer like you who wants "low price" and "good quality," FOB is usually the best. It gives you transparency. However, you must be prepared to handle the customs entry.

How Can B2B Bag Buyers Reduce Tariff Risk Without Delaying Orders?

Waiting for the government to decide on rates is dangerous. Do you have a plan to keep your supply chain moving smoothly?

To reduce risk, define the HS Code and value in your contract before production starts. You should also split shipments to hedge against rate spikes and keep a clear paper trail of all materials. This turns unpredictable costs into manageable variables for your business.

Uncertainty is the enemy of business. You cannot price your products for your customers if you do not know your own costs. Tariffs create uncertainty. However, we can manage this.

Here is a strategy I recommend to my long-term clients to minimize the impact of 2026 tariff changes:

1. Lock in the Code Early: Do not wait until the goods are on the ship to decide the HS Code. We should agree on the HS Code during the sample stage. We can write this code into the Purchase Order. This ensures we are both thinking about the same duty rate4.

2. Split Your Shipments: If you have a large order, do not ship it all at once. Divide it into three or four shipments. If a new tariff is announced suddenly, you might get some goods in before the deadline. It spreads your risk. It is like investing; do not put all your eggs in one basket.

3. Honest Valuation: Some suppliers offer to lower the invoice value to save on taxes. Do not do this. Customs authorities have data on everything. If they see a price that is too low, they will flag your shipment. The fines are much higher than the tax you save. At Coraggio, we stick to honest, accurate invoicing. This builds a reputation with customs that speeds up your clearance in the future.

4. Flexible Material Options: We can design your bag with "Tariff Engineering" in mind. For example, if a bag is 51% cotton, it might have a lower rate than if it is 51% polyester. We can adjust the blend of the fabric to help you qualify for the better rate without changing the look or quality of the bag.

By taking these steps, you stop being a victim of policy changes. You take control. You turn a chaotic situation into a standard business process.

Conclusion

Tariffs change your landed cost3, but preparation saves your margin. Verify HS codes6, choose the right Incoterms11, and work with an experienced manufacturer to manage these risks effectively.

Explore strategies to safeguard your profits amidst rising costs and tariffs. ↩

Identifying hidden costs can help you budget more accurately and avoid surprises. ↩

Learn how to calculate landed costs to ensure accurate pricing and profitability. ↩

Knowing the duty rate helps you calculate total costs and set competitive prices. ↩

Stay informed about customs policies to ensure compliance and avoid delays. ↩

Understanding HS codes is crucial for minimizing import taxes and avoiding penalties. ↩

Understanding tariff trends can help you anticipate costs and adjust your pricing strategy. ↩

Understanding these fees can help you anticipate additional costs in your budget. ↩

Learn about harbor fees to better manage your shipping expenses. ↩

Understanding this concept can help you qualify for lower tariffs. ↩

Learn how Incoterms affect shipping costs and responsibilities. ↩

Knowing how import duties are calculated can help you manage your expenses effectively. ↩