You order thousands of bags from China. You expect them to arrive on time. But customs holds your shipment, and you face delays and fines.

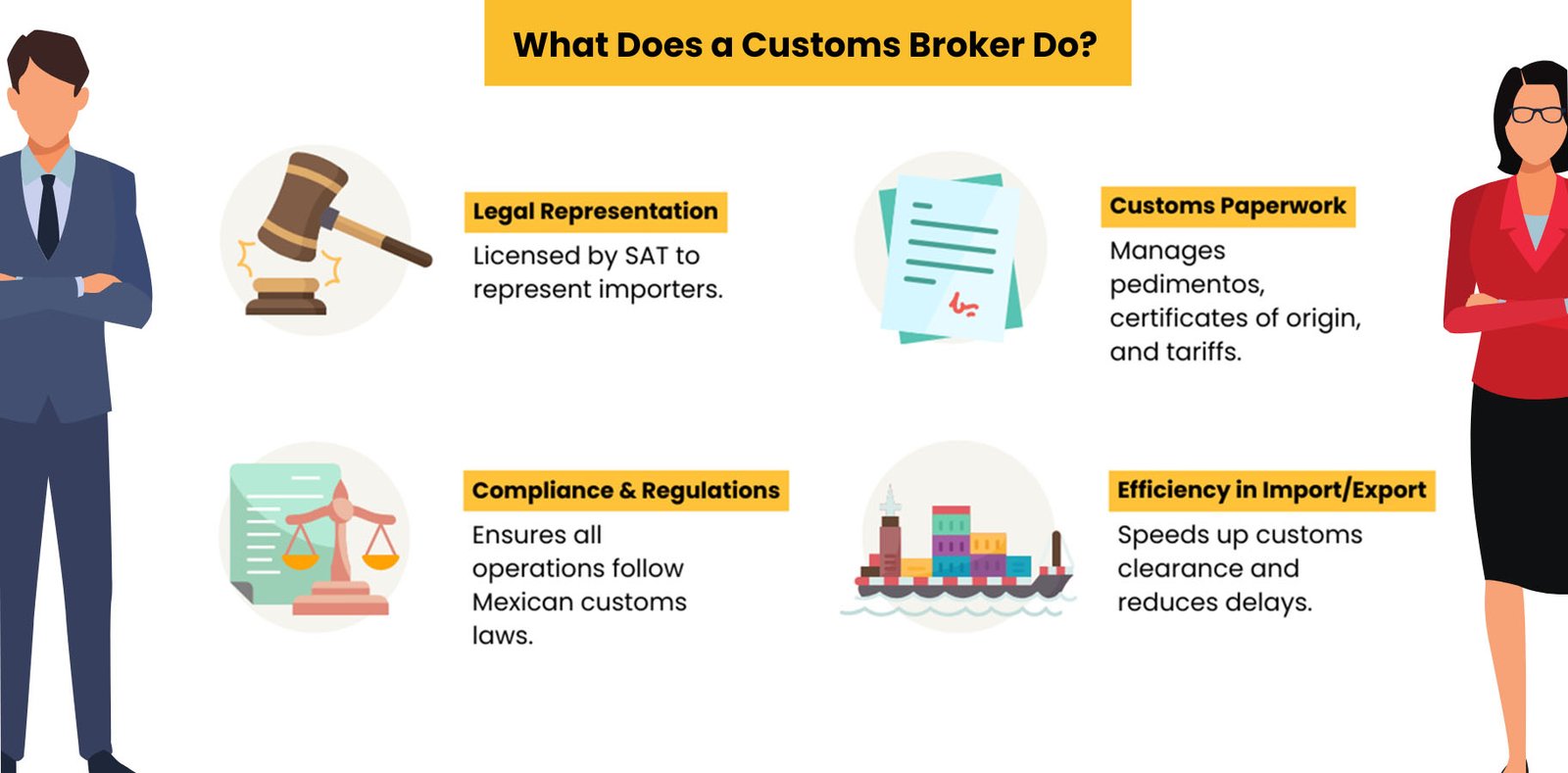

A customs broker1 is a licensed professional who helps you clear goods through customs barriers. They calculate duties, classify your bags with the right HS codes2, and submit documents like invoices to government agencies. They ensure your bulk orders move from the port to your warehouse without legal trouble.

This guide will explain everything you need to know about using a broker.

What Is a Customs Broker for Bag Imports?

Importing goods involves complex laws. If you break a rule, you lose money. You need an expert to protect your business interests.

A customs broker1 is an agent or company licensed by the local government to handle import procedures3 for you. They act as the bridge between the bag buyer and the customs authorities4. They ensure your imported bags meet all legal requirements before they enter the country.

I have been in the bag manufacturing business for 15 years. I have seen many buyers try to handle customs alone. It often ends in frustration. A customs broker1 is not just a paperwork filler. They are specialists in trade law. When you buy bags from my factory in China, the goods must cross borders. Every country has different rules.

The broker represents you. They speak the language of the customs officers. They know the latest regulations. For example, the rules for importing a cotton tote bag are different from a cooler bag. The broker knows these differences. They prepare the entry forms. They pay the duties on your behalf. They get the release order.

Think of them as your insurance policy against border delays. If you are a large buyer like Mark, you do not have time to study tariff books. You need to focus on sales. The broker handles the technical side. They make sure the government gets its tax so you can get your bags.

| Feature | Self-Clearing | Using a Customs Broker |

|---|---|---|

| Knowledge | You must study laws | Expert knowledge provided |

| Risk | High risk of errors | Low risk of penalties |

| Time | Very time-consuming | Saves your time |

| Cost | No service fee | Service fee applies |

| Speed | Often slower | Faster release |

What Does a Customs Broker Handle for Bag Shipments?

Paperwork mistakes cause most shipping delays. You want to avoid expensive storage fees at the port. A broker manages these details for you.

Your broker handles the classification of goods, calculation of taxes, and communication with officials. They review your commercial invoice5, packing list6, and bill of lading7. They identify the correct Harmonized System (HS) codes for your specific bag materials to determine the duty rate.

The most critical task a broker does is HS code classification. This sounds simple, but it is not. A backpack made of polyester has a different code than a backpack made of leather. If you use the wrong code, two bad things can happen. First, you might pay too much tax. Second, you might pay too little tax and get fined later.

My team at Coraggio provides the product details. We tell you the fabric composition. The broker takes this info and finds the exact code. They also calculate the total landed cost. This includes the Value Added Tax (VAT) and any excise duties.

They also handle "other government department" requirements. Sometimes, bags need safety checks8. Or they need checks for toxic chemicals. The broker submits these forms too. They track the shipment electronically. When the ship arrives, they already have the paperwork in the system.

Here is a breakdown of their specific tasks:

- Document Audit: They check the papers I send you for errors.

- Entry Filing: They submit the electronic data to Customs.

- Duty Payment: They facilitate the transfer of funds to the government.

- Problem Solving: If customs flags your container for inspection, the broker answers their questions.

- Record Keeping: They keep digital copies of your imports for audit purposes.

Do Bag Buyers Need a Customs Broker or a Freight Forwarder?

Shipping terms can be confusing. You might think one company does it all. But moving goods and clearing goods are different jobs.

A freight forwarder9 moves your cargo from point A to point B, while a customs broker1 gets it through the legal border. You usually need both services. Some freight forwarder9s have in-house brokers, but they are distinct roles with different responsibilities in the supply chain.

I often explain this to new clients. The freight forwarder9 is like a travel agent for your cargo. They book the space on the ship. They arrange the truck to pick up the bags from my factory. They handle the physical movement.

The customs broker1 is like a lawyer. They deal with the government. They handle the legal entry.

Can you use one company for both? Yes. Many large logistics companies10 offer both services. This can be convenient. However, some experienced buyers prefer to keep them separate. They use a specialized broker for better compliance.

Why does this matter? Because a freight forwarder9 might not know the specific nuances of textile imports11. Bags have complex duty rates based on material weight and coating. A general forwarder might miss these details. A specialized broker will ask the right questions.

If you buy Incoterms like DDP (Delivered Duty Paid), the seller (me) handles the broker. But if you buy FOB (Free on Board), which is common, you control the shipping. You need to hire these partners.

| Aspect | Freight Forwarder | Customs Broker |

|---|---|---|

| Primary Focus | Logistics & Transport | Compliance & Law |

| Main Action | Moves the bags | Clears the bags |

| Agency | Deals with carriers/airlines | Deals with Government/Customs |

| Key Skill | Route planning | Tariff classification |

| Outcome | Goods arrive at port | Goods are released to you |

What Documents Are Required to Clear Imported Bags?

Missing a single piece of paper stops everything. Your bags sit at the dock while you scramble. You must know what documents to prepare.

To clear customs, you generally need a Commercial Invoice, a Packing List, and a Bill of Lading. You may also need a Certificate of Origin12 to reduce duties. Your broker submits these to prove the value, quantity, and origin of your bags.

My design and export team works hard to make these documents perfect. We know that if we make a typo, your broker cannot do their job.

The Commercial Invoice is the most important. It tells customs what you bought and how much you paid. It must list the bag descriptions clearly. For example: "600D Polyester Cooler Bag with PEVA lining." It cannot just say "Bags." The broker uses this description to prove the value to customs.

The Packing List shows how the goods are packed. It lists the gross weight and net weight. Customs officers use this if they decide to inspect the container. They need to know which box holds which style.

The Bill of Lading (B/L) is the title of the goods. It proves you own the cargo. The broker needs this to claim the shipment.

The Certificate of Origin12 is vital for saving money. Many countries have trade agreements. For example, if your country has a deal with China or Vietnam, you might pay less duty. This paper proves where the bags were made.

Sometimes, you need extra tests. If the bags are for children, you might need a safety certificate. If the bags touch food (like cooler bags), you might need FDA-related documents in the US. Your broker will tell you exactly what is needed based on the product type.

- Commercial Invoice: Proof of value.

- Packing List: Proof of physical count.

- Bill of Lading: Proof of ownership.

- Arrival Notice: Alert from the carrier.

- Customs Bond: Insurance for tax payment (required in the US).

How to Choose the Right Customs Broker for Bag Imports?

Not all brokers are the same. A bad broker can cost you thousands in fines. You need a partner who understands your specific business.

You should choose a broker with experience in textiles and consumer goods. Look for a company that uses modern software for digital filing13. They must be responsive, transparent about their fees, and willing to explain the complex regulations regarding bag materials.

When you look for a broker, do not just look at the price. The cheapest broker might cost you more in the long run. You need someone who asks questions.

If I send you a sample of a canvas tote bag, a good broker will ask: "Is the lining synthetic or cotton?" This question changes the tax rate. A bad broker will guess. Guessing is dangerous.

You should ask them about their technology. Can you see your shipment status online? Do they have a portal? Modern brokers use digital tools to speed up the process. This helps you plan your inventory.

Also, check their hours. We are in China. There is a time difference. If you have an urgent issue, can you reach them? Good communication is key.

You should also ask about their network. Do they have offices at the major ports where you import? If you import to Vancouver, a local broker there might have better relationships with the local officers.

Here is a checklist for your search:

- Specialization: Do they handle other fashion or textile clients?

- References: Can they give you a number of a current happy client?

- Fees: Do they charge a flat fee or a percentage? Are there hidden costs?

- Support: Will you have a dedicated account manager?

- Audit Support: If you get audited later, will they help you?

Conclusion

A customs broker1 acts as your essential partner for importing bags safely and legally. They handle the complex HS codes2, manage duty payment14s, and prevent costly delays at the border.

Explore this resource to understand the vital role customs brokers play in facilitating smooth import processes. ↩

Learn about HS codes and their significance in determining duties and taxes for your imported goods. ↩

This link will provide insights into the necessary steps and regulations for importing goods effectively. ↩

Understanding the role of customs authorities can help you navigate the import process more effectively. ↩

Understanding the commercial invoice is crucial for ensuring compliance and smooth customs clearance. ↩

Explore the importance of a packing list in the customs clearance process and how to prepare one. ↩

Learn about the bill of lading and its significance in proving ownership of your cargo. ↩

Learn about the necessary safety checks for certain products to ensure compliance with regulations. ↩

This resource clarifies the distinct roles of customs brokers and freight forwarders in the shipping process. ↩

Learn about the various services provided by logistics companies to facilitate smooth imports. ↩

Explore the specific regulations and requirements for importing textiles to ensure compliance. ↩

Find out how a Certificate of Origin can help reduce duties and facilitate smoother imports. ↩

Discover how digital filing can streamline the customs clearance process and improve efficiency. ↩

Explore how duty payments are calculated and the factors that influence these costs. ↩