Are you struggling with rising production costs and unpredictable supply chains? Sourcing bags is getting harder every year, and ignoring new manufacturing markets might cost you your business.

Southeast Asia1 is emerging as a core hub because of its massive young workforce, rapid economic growth creating new consumers, and strategic trade agreements2 like RCEP. These factors combine to offer lower manufacturing costs3 and a booming local market4 for global buyers.

I have seen many changes in the bag industry over the last 15 years at Coraggio5. The shift to Southeast Asia1 is the biggest one yet. Let me explain why this region is crucial for your business right now.

How Is the Labor Force Transforming Manufacturing?

Finding skilled workers6 at a low price is a nightmare for buyers today. Factory costs in traditional regions are eating your profits, making it very hard to compete on price.

The region offers a massive "demographic dividend7." With a young, abundant workforce and global companies moving production there, Southeast Asia1 is rapidly becoming the world's primary factory for bags.

I have been in this industry for 15 years. I own a factory in China with 120 workers. I see the trend clearly. Many big brands are moving their orders to Vietnam, Cambodia, and Indonesia. Why are they doing this? It is mainly about the people. In China, the workforce is getting older. In Southeast Asia1, the workers are young. They have a lot of energy. This is what economists call the "demographic dividend7."

This shift is not just about cheap labor. It is about availability. When you place a large order for duffle bags or backpacks, you need a factory that can hire people quickly. Southeast Asia1 can do this. The global supply chain8 is diversifying. This means companies do not want to rely on just one country anymore. This strategy is often called "China Plus One9."

I have spoken to many of my friends who run factories in Vietnam. They tell me the workers are learning fast. Ten years ago, they could only make simple shopping bags. Now, they can make complex hiking backpacks and cooler bags. The quality gap is closing. As a buyer, you must look at this region if you want to keep your prices low.

However, it is not perfect yet. They still import many raw materials from China. But the assembly happens there. This combination helps control costs. You need to understand the cost structure to negotiate better.

| Factor | Traditional Hubs (e.g., East China) | Southeast Asia1 (e.g., Vietnam/Indonesia) |

|---|---|---|

| Labor Cost | High and rising | Low and stable |

| Worker Age | Aging population | Young, large workforce |

| Skill Level | Very High (15+ years exp) | Medium to High (Rapidly improving) |

| Capacity | Stable | Rapidly expanding |

| Supply Chain | Complete ecosystem | Growing, relies on imports |

Will the Rise of the Middle Class Drive New Demand?

You worry about where to sell your products when Western markets slow down. Traditional markets are becoming saturated, and you need new growth areas to survive in the future.

The region is not just a factory; it is a massive customer. With rapid GDP growth and 140 million new consumers expected soon, the rising middle class10 demands fashionable bags.

We used to think of Southeast Asia1 only as a place to make things. We thought of it as a factory floor. That is a mistake. Now, they buy things. I visited a mall in Bangkok recently. It was full of people. They were buying high-end tote bags and travel luggage. The local economy is growing very fast.

Experts say that in the next five years, 140 million new consumers will enter the market. These people are becoming "middle class10." What does this mean for us? It means they have extra money. They do not just buy food. They buy fashion. They travel. When people travel, they need suitcases. When they go to the office, they need laptop backpacks. When they go out for dinner, they need cosmetic bags.

This is a huge opportunity for your brand. You can produce goods there and sell them there. This saves on shipping costs. The demand is shifting. In the past, all the high-quality orders went to Europe or North America. Now, we see orders for high-quality goods going to Singapore and Thailand.

I have noticed a change in my own orders at Coraggio5. We are getting more inquiries from local distributors in this region. They want the same quality as my Canadian clients. They want eco-friendly materials11 too. They are very modern. If you are a buyer who rebrands products, this is a new market for you to sell into. You are not just sourcing; you are entering a new economy.

| Consumer Trend | Impact on Bag Industry |

|---|---|

| Rising Income | Higher demand for premium materials (Leather, Nylon) |

| Urbanization | Need for functional work bags and laptop backpacks |

| Tourism Growth | Explosion in demand for luggage and travel accessories |

| Fashion Awareness | Faster turnover of styles and designs |

Do Trade Agreements and Geography Boost Efficiency?

Shipping delays and high import taxes kill your profit margins every season. You feel stuck with slow logistics12 and expensive tariffs that hurt your bottom line significantly.

Southeast Asia1 sits at the crossroads of global trade routes. Agreements like RCEP lower tariffs, while green trade13 initiatives improve efficiency in sourcing materials and shipping finished goods.

Location is everything in the bag trade. Look at the map. Southeast Asia1 is right in the middle of the ocean routes. Singapore is one of the busiest ports in the world. This geography is a natural advantage. It makes shipping to Europe and North America easier. But there is something even more important than geography. It is policy.

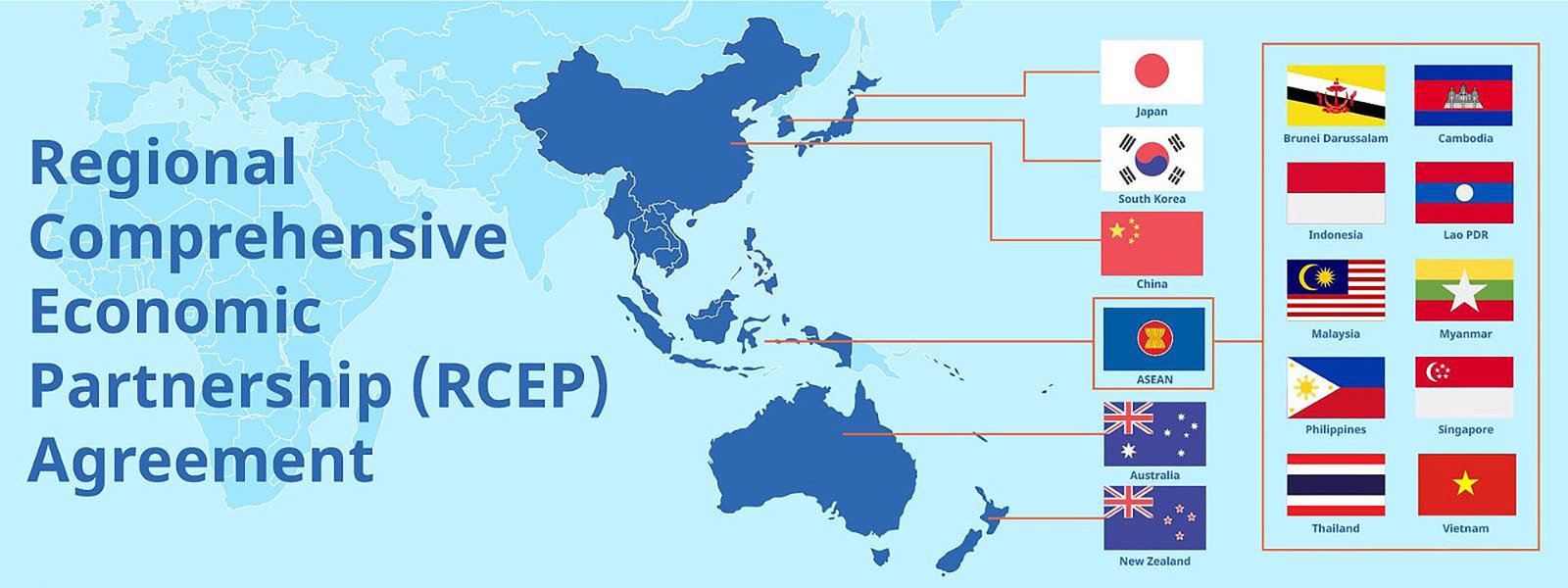

The RCEP (Regional Comprehensive Economic Partnership) is a big deal. It is a trade agreement between many countries in Asia. It reduces taxes (tariffs) on goods moving between these countries. For a bag manufacturer, this is huge.

Let me give you an example. I buy fabric from China. If I ship it to a factory in Vietnam to make the bag, and then ship the bag to another RCEP country, the taxes are very low. This lowers the total cost of the product. As a buyer from Canada, this might not seem to affect you directly at first. But it does. It lowers the cost of production for your supplier. If their costs are lower, your price should be lower.

Also, there is a big push for "Green Trade." Southeast Asia1 is trying to be more sustainable. They are investing in cleaner ports and better logistics12. At Coraggio5, we focus on eco-friendly materials11. We see that moving goods through efficient, modern ports helps us keep our promise of "on-time delivery."

You hate delays. I know this. My customers always ask about the delivery date first. The improvements in Southeast Asia1's infrastructure help solve this. The roads are getting better. The ports are faster. This efficiency confirms the region as a global hub. It is not just about cheap labor anymore. It is about a smart, connected supply chain.

| Trade Factor | Benefit to the Buyer |

|---|---|

| RCEP Agreement | Lower cost of raw materials moving across borders |

| Strategic Location | Shorter shipping times to multiple continents |

| Port Infrastructure | Fewer delays and better handling of goods |

| Green Trade Focus | Easier to meet sustainability certifications |

Conclusion

Southeast Asia1 is the future for both making and selling bags. You must pay attention to its labor, growing market, and trade benefits to stay competitive in this industry.

Explore the benefits of Southeast Asia as a manufacturing hub, including cost savings and a young workforce. ↩

Discover how trade agreements can lower costs and improve trade efficiency for manufacturers. ↩

Discover strategies to lower manufacturing costs and improve profit margins in a competitive market. ↩

Explore the potential of the local market in Southeast Asia for expanding your business. ↩

Discover Coraggio's manufacturing capabilities and eco-friendly bag solutions to see how their 15 years of industry experience can benefit your brand. ↩

Explore resources for locating skilled labor in Southeast Asia to enhance your manufacturing capabilities. ↩

Learn how the demographic dividend is transforming the labor market and manufacturing capabilities in Southeast Asia. ↩

Understand the evolving dynamics of the global supply chain and how to adapt your sourcing strategies. ↩

Find out how the China Plus One strategy can diversify your supply chain and reduce risks. ↩

Learn about the impact of the rising middle class on consumer behavior and market opportunities. ↩

Learn about the advantages of eco-friendly materials and their impact on brand reputation. ↩

Explore best practices for optimizing logistics to enhance supply chain efficiency. ↩

Understand the significance of green trade initiatives in promoting sustainability in manufacturing. ↩